On July 30, the first session of the "Star Lai Public Welfare Lecture Series on Civil-Administrative-Criminal Integration: Integrated Governance of Securities-Related Crimes" was successfully held at Star Lai Law Firm in Beijing. This event was hosted by the School of Criminal Justice at China University of Political Science and Law and Beijing Xinglai Law Firm, with the School of Criminal Justice at China University of Political Science and Law’s Xinglai Integrated Research Base for Civil, Administrative, and Criminal Law serving as the organizer. It brought together leading experts from academia, the judiciary, and legal practice. The event adopted a hybrid model—combining in-person participation with live online streaming—drawing nearly 2,500 legal professionals both on-site and online, including over 2,400 participants engaging remotely. This made it a premier platform for high-level academic and practical exchanges in the field of securities-related crimes.

Multidimensional Perspective

Analyzing the Current Status and Challenges in Securities Crime Governance

The meeting was hosted by Yin Bo, Professor and Doctoral Supervisor at the School of Criminal Justice, China University of Political Science and Law Moderator, Wang Jun, Director and Founding Partner of Beijing Xinglai Law Firm, and Executive Director of the Integrated Research Base for Civil, Administrative, and Criminal Law. Opening remarks: Director Wang Jun pointed out that in recent years, the number of securities-related illegal and criminal cases has been on the rise, prompting increasingly stringent regulatory measures. The establishment of a robust two-way coordination mechanism between administrative and criminal enforcement has led to a comprehensive, multi-layered regulatory framework. As a result, the intersection of civil, administrative, and criminal issues has become one of the most challenging problems in practice. The purpose of today’s event is to create a cross-disciplinary platform for dialogue, offering systematic solutions to address legal risks in the securities sector.

During the keynote speech session, Wang Xin, Professor at Peking University Law School and PhD supervisor, Adjunct Professor at the National Prosecutors College, and Vice Chairman of the International Criminal Law Branch of the Chinese Society of Criminal Law Studies Professor Let's delve into an in-depth discussion on the topic of "Criminal Legal Regulation and Judicial Determination of Securities Crimes in China." He highlighted that, following the 2019 revision of the Securities Law, financial regulators have stepped up their oversight efforts, with the Central Office and the General Office adopting a "zero-tolerance" approach toward securities-related offenses. Currently, while traditional types of crimes still dominate, there has been a noticeable rise in cases involving financial fraud. Professor Wang Xin drew on several high-profile case examples to explain the evolving judicial standards for identifying financial fraud crimes, shedding light on challenging issues such as distinguishing among different charges and clarifying liability structures. Additionally, he pointed out that securities crime prosecutions face significant hurdles, including lengthy enforcement processes, ongoing disputes over penalty calculations, and complex legal interpretations. To address these challenges, he advised lawyers to leverage case studies effectively and encouraged the industry to establish specialized research centers aimed at standardizing legal interpretations and practices.

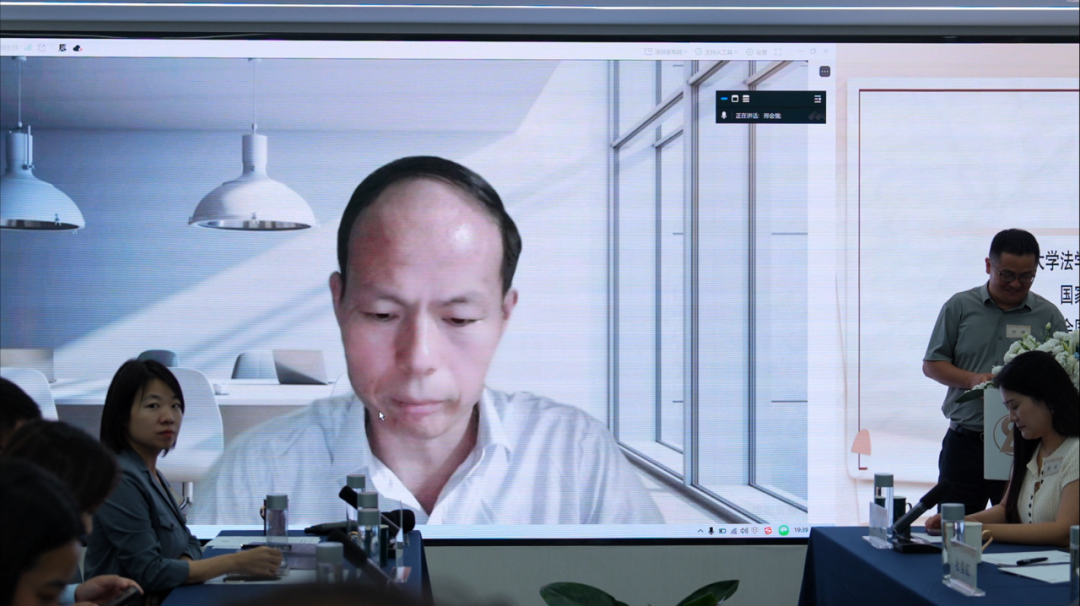

Xing Huiqiang, Professor at the School of Law and Doctoral Supervisor at the Central University of Finance and Economics, as well as Vice President and Secretary-General of the Securities Law Research Association of the China Law Society. Professor An online discussion was held on the issue of insider trading. He emphasized that the significance of insider information lies at the heart of securities law—but unfortunately, in many regions today, the threshold for determining the materiality of such information continues to decline, often blurring the line with the standards used for disclosing material information. This inconsistency undermines fundamental principles. Professor Xing illustrated this point by referencing a hypothetical "blind date" merger scenario, highlighting how subjective and arbitrary enforcement approaches can lead to unnecessary regulatory burdens. He also pointed out the dual standards currently applied in identifying insider information, urging a reevaluation of the rigid "absolute information equality" theory to prevent the overcriminalization of insider trading. Instead, he advocated for returning to more balanced and realistic materiality criteria, suggesting that a probability threshold of 50% or higher should serve as the benchmark. Finally, he stressed the critical need for enforcers and judges to approach these issues with scientific rigor, rational thinking, and unwavering confidence.

Discussion and Exchange

Sharing case-handling experiences and industry pain points

During the practical dialogue session, lawyers shared their valuable hands-on experience based on their own case-handling practices, while also highlighting the industry's key pain points.

Li Shoushuang, Senior Partner at Beijing Dacheng Law Firm Drawing from practical cases, the paper highlights practical insights such as "legal defense works effectively, while seeking help from others does not," and points out the current inconsistency between administrative penalties and criminal accountability standards.

Song Wei, Partner at Global Law Firm in Beijing Looking back at past cases of securities-related crimes, we emphasize the critical importance of aligning administrative enforcement with criminal justice—specifically, ensuring robust evidentiary standards and transparent procedures throughout the process.

Wang Ying, Deputy Director of the Management Committee at Beijing Xinglai Law Firm Taking a personally handled case as an example, the article highlights procedural disputes in the China Securities Regulatory Commission's enforcement actions, such as issues like "the right to review audit working papers" and "the absence of a collective discussion system," while calling on regulators to enhance transparency in their enforcement practices.

Public Welfare Empowerment

Promoting professional and meticulous governance of securities-related crimes

The first session of the Star-Lai Public Welfare Lecture Series on Integrated Criminal and Administrative Enforcement has successfully concluded. This lecture series combines significant academic value with practical guidance. Addressing securities-related crimes is not only a legal issue but also a cornerstone for maintaining financial stability and investor confidence. The successful organization of this public welfare lecture marks an important step forward in advancing the professionalization and refinement of securities crime governance, offering fresh insights for future industry collaboration and judicial practice.

The Star-Lai Public Lecture Series on the Integration of Civil and Criminal Justice will continue in the future, with even more exciting content and insightful discussions ahead—stay tuned!

Beijing Headquarters Address: No. 8 Jianguomen North Avenue, Dongcheng District, Beijing 17th Floor, East Wing, China Resources Building

Wuhan Branch Office Address: Room 1001, 10th Floor, Huangpu International Center, Jiang'an District, Wuhan City, Hubei Province

Edited and Layouted by: Wang Xin

Review: Management Committee

Related News