Recently, the Beijing Lawyers Association’s Criminal Procedure Committee successfully held its June sharing session in the second video conference room on the third floor of the association. The meeting focused on current hot topics and challenges in the legal field—specifically, practical issues surrounding criminal cases involving virtual currencies—drawing in numerous lawyer colleagues for lively discussions. Wang Jun, Director of Xinglai Law Firm and a member of the Criminal Procedure Committee, was invited as the keynote speaker. Drawing on her extensive hands-on experience, she provided an in-depth analysis of judicial identification, key defense strategies, and the latest trends in verdicts related to virtual currency crime cases, offering attendees a unique and insightful practical guide.

With the rapid advancement of digital technology, virtual currencies are increasingly appearing in criminal cases—ranging from pyramid schemes and illegal public deposit-taking to activities like running online casinos and money laundering. These cases span a wide array of offenses and are spread across diverse geographic regions, while their legal status remains highly controversial. From deep involvement as tools or accomplices in these crimes, virtual currencies pose significant challenges to criminal justice practices. Against this backdrop, the Criminal Procedure Committee of the Beijing Lawyers Association has organized this training session, aiming to enhance lawyers' expertise in handling criminal cases involving virtual currencies and to create a dedicated platform for professional exchange and learning within the legal community.

At the meeting, Director Wang Jun leveraged her solid professional expertise and extensive case experience to provide an in-depth analysis of virtual currency-related criminal cases from multiple perspectives. She first briefly outlined the distribution of case types and geographical patterns associated with these crimes, then delved into the specific roles virtual currency plays across different categories of offenses. For instance, in cases involving pyramid schemes or illegal public deposit-taking, virtual currency is often used as a deceptive facade for investment and sales activities; meanwhile, in casino operations, it serves as a key medium for converting gambling funds. Through detailed case studies and legal interpretations, attendees gained a clear understanding of the complex ways virtual currency is intertwined with criminal activities.

In addition, Director Wang Jun delved into the challenges associated with virtual currency as evidence in criminal cases—specifically, the complexities involved in the seizure and freezing processes, valuation procedures, disposal and monetization steps, and the subsequent recovery and confiscation phases. Given the inherently electronic nature of virtual currencies, the seizure and freezing stages often rely on third-party companies, posing significant technical preservation challenges. Moreover, the valuation process lacks standardized criteria and reliable domestic institutions, while global market prices remain highly volatile. Domestically, the absence of a legitimate trading platform further complicates efforts to liquidate and convert these assets into cash, leaving open the question of viable approaches for doing so.

In defending criminal cases involving virtual currencies, Director Wang Jun highlighted several key defense strategies. These include arguing the property status of virtual currencies by analyzing how their classification has evolved across various stages of regulatory policies, and drawing on recent court cases to illustrate how legal practice has now reached a consensus that virtual currencies indeed possess property-like characteristics. Another focus is on debating the valuation of these assets, examining both the criteria used for determining their worth and the challenges faced by relevant institutions in this process. Additionally, she emphasized the importance of scrutinizing electronic evidence, providing practical insights into the critical review points and techniques involved. Lastly, her approach addresses the legal applicability of virtual currencies within the broader context of the traditional financial system, while also tackling jurisdictional and evidentiary issues related to cross-border cases—specifically clarifying why it is illegal for overseas exchanges to provide services to residents within China, and outlining the legal grounds for holding them accountable.

This training provided participating lawyers with a valuable opportunity to systematically learn practical knowledge related to criminal cases involving virtual currencies, helping them further enhance their professional expertise and case-handling skills in this specialized area. Through Director Wang Jun’s detailed explanations and insightful case analyses, the training offered invaluable guidance on handling real-world challenges in virtual currency-related criminal cases, enabling attendees to better understand and effectively address the complexities of such matters. At the same time, the workshop fostered greater communication and collaboration among lawyers, creating a platform for sharing experiences within the industry and driving collective progress.

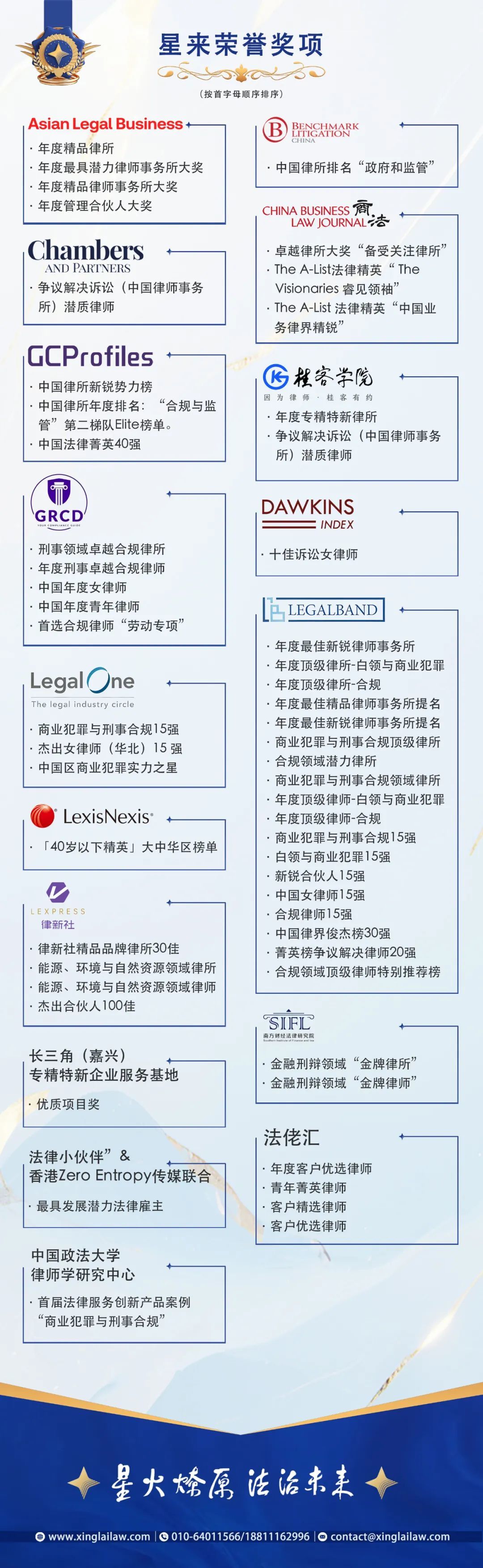

In the future, Xinglai Law Firm will continue to dedicate itself to all activities of the Bar Association with the same enthusiasm and proactive attitude, fully leveraging our professional strengths to inject continuous momentum into the industry's growth—and through concrete actions, we’ll contribute Xinglai’s wisdom and strength to the sector’s ongoing prosperity.

Beijing Headquarters Address: Floor 17, East Section, China Resources Building, No. 8 Jianguomen North Avenue, Dongcheng District, Beijing

Wuhan Branch Office Address: Room 1001, 10th Floor, Huangpu International Center, Jiang'an District, Wuhan City, Hubei Province

Edited and Layouted by: Wang Xin

Review: Management Committee

Related News